If you’ve shopped for a new laptop, phone, mini PC or gaming handheld lately, there’s a good chance you’ve noticed something quietly inflating the final price: memory. RAM, once one of the cheapest ways to boost performance, is becoming a meaningful cost driver again — and this cycle is different to the usual swings the semiconductor industry is famous for.

This time, the pressure isn’t coming from gamers or PC builders. It’s coming from the global AI arms race.

Massive data centres powering generative AI, cloud services and advanced analytics are consuming memory at unprecedented levels. Modern AI systems are extremely memory-hungry, relying not only on standard DRAM but also on specialised High Bandwidth Memory (HBM) stacked directly onto GPUs. These parts are far more complex to manufacture and command much higher margins, making them incredibly attractive to memory suppliers.

The result is a market where the biggest tech companies are consuming the available supply, and everyone else — from phone makers to laptop brands — is left competing for what’s left.

WHY PRICES ARE RISING?

At a fundamental level, the problem is not just demand, but where that demand is coming from.

AI infrastructure has become the most profitable destination for memory chips. A single AI server can use vastly more memory than an entire household’s worth of consumer devices, and hyperscale data centre operators are buying in volumes that dwarf traditional PC and phone orders. For memory manufacturers, it makes far more sense to prioritise these customers.

At the same time, memory production cannot be ramped up quickly. New fabs take years to build, and HBM in particular is difficult to manufacture and package. Even when companies invest billions into new facilities, meaningful supply relief tends to arrive slowly and unevenly.

This combination of soaring AI demand, limited manufacturing capacity and strategic prioritisation of higher-margin customers has shifted pricing power firmly into the hands of memory suppliers. Contract prices for conventional DRAM have already jumped sharply, and those increases are now flowing into consumer products.

WHAT CONSUMERS ARE SEEING

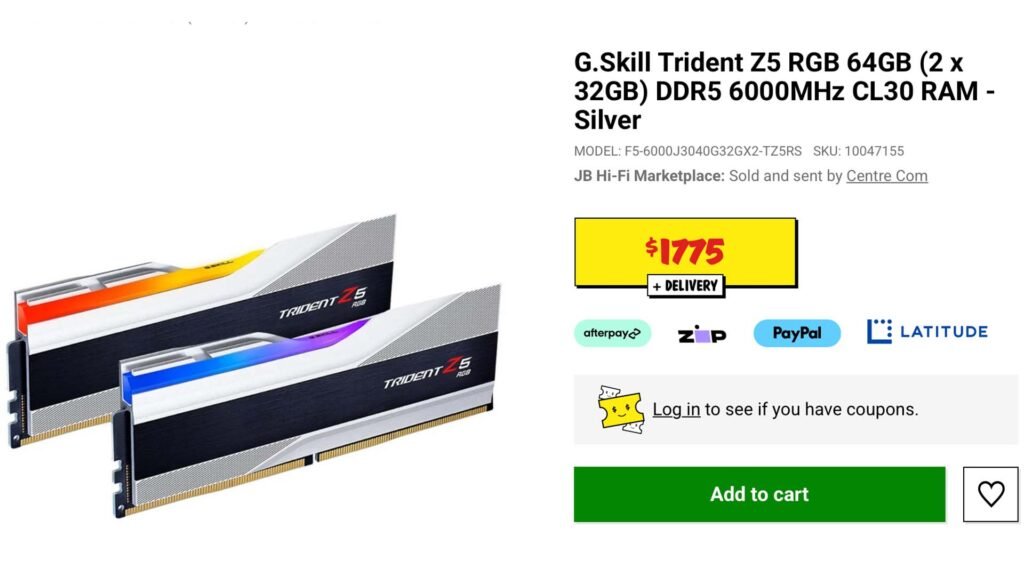

For PC buyers, the impact is becoming obvious. DIY builders are finding that memory kits are no longer the easy bargain upgrade they once were, and laptop manufacturers are becoming far more conservative with base configurations. Sixteen gigabytes is once again the “safe default”, while 32GB upgrades carry steeper premiums — especially in thin-and-light laptops where memory is soldered and can’t be upgraded later. There are plenty of examples of the prices rising year on year, but the price of RAM has been steeper than any other component; the G.Skill 32GB DDR5 7600 kit I purchased for my new PC just over 18 months ago, for just shy of AU$300, is now an unaffordable AU$1,250 or higher depending on the supplier with other kits (spec dependent) topping AU$1,700.00

Gaming handhelds and mini PCs are particularly sensitive to memory pricing because RAM represents a large slice of their total build cost. When memory goes up, the entire device gets more expensive.

In smartphones and tablets, memory makes up a smaller portion of the total bill of materials, but the pressure is still there. Entry-level and mid-range devices are feeling it first, because these products operate on razor-thin margins. In practical terms, that means fewer “free” storage upgrades, fewer aggressive promotions, and, in some cases, higher prices for budget models that used to undercut the market.

Even consoles and mainstream consumer electronics are not immune. As component costs rise across the board, manufacturers face a choice between absorbing the hit to profit or passing it on to buyers. Increasingly, they’re doing a bit of both.

IMPACT PREDICTIONS: SHORT, MEDIUM AND LONG-TERM

In the short term, prices are likely to remain hot and volatile. Contract pricing for memory tends to flow through to retail with a delay, so what manufacturers are paying now shows up in consumer products months later. That means the cost pressure we’re seeing today will continue to ripple through new product launches well into 2026.

Brands are responding in predictable ways. Some are raising prices outright. Others are quietly adjusting specifications, keeping prices stable while trimming storage or RAM. And many are becoming more aggressive about segmentation, charging clear premiums for higher-memory configurations.

Over the medium term, there may be some easing as new capacity comes online and demand fluctuations smooth out. But a return to the era of dirt-cheap RAM seems unlikely unless there is a major slowdown in AI investment or a sudden surge in manufacturing output. Even then, memory suppliers have little incentive to flood the market and collapse pricing again.

In the long term, the market may be undergoing a structural shift. AI has turned memory into a strategic resource, not just a commodity PC component. If data centres continue to grow faster than consumer devices, memory makers will increasingly design their businesses around enterprise and AI demand first, with consumer products fitting around whatever capacity remains.

In other words, the days when RAM was the cheapest upgrade in your build may be behind us.

WHAT THIS MEANS FOR BUYERS

For consumers, the new reality is simple: memory matters more than it used to. If you’re buying a device with soldered RAM, it’s worth paying for the configuration you’ll need long-term rather than hoping to upgrade later. For desktops, buying sooner rather than later can make sense if prices continue climbing.

We’re also likely to see more value hidden in bundles and promotions, where manufacturers and retailers use CPUs, laptops or full systems to disguise the true cost of memory inside a broader deal.

RAM isn’t just another component anymore. In an AI-driven world, it’s becoming one of the most valuable pieces of silicon in the entire tech stack — and consumers are starting to feel the consequences. If you’re considering an upgrade, don’t wait: Buy now before the prices go even higher.